- Diana Bolton

Leaders of the Vermont solar firm iSun misled shareholders and engaged in "extensive" wrongdoing, including fraud and misappropriation of funds, according to a former executive who was recruited to fix the publicly traded company in the months before its June bankruptcy.

Top executives listed their spouses as employees to obtain more government aid during the pandemic, took title to company cars and breached loan agreements as they became desperate for cash, former iSun CEO Robert Zulkoski alleges in a whistleblower complaint obtained by Seven Days.

Company officials and iSun's board of directors concealed the information from stockholders, he claims. Meanwhile, the top executives reaped six-figure bonuses.

Zulkoski leveled his accusations in a June 7 letter to the U.S. Securities and Exchange Commission days after iSun filed for bankruptcy protection. The seven-page document, penned by an attorney representing Zulkoski, is addressed to the SEC's confidential whistleblower program.

The SEC does not comment on its investigations and would not confirm whether it received a complaint or is looking into iSun. Zulkoski confirmed that he had filed the complaint but declined to comment further.

Zulkoski's complaint calls into question the bankruptcy narrative put forth by iSun's current leaders. It could expose the company to more scrutiny at a time when its future appears to hinge on a quick, court-overseen sale.

CEO and chairman Jeff Peck and iSun bankruptcy attorney Michael Busenkell declined to comment on Zulkoski's allegations. Independent board member Claudia Meer said board members could not comment, either.

Former chief financial officer John Sullivan, who Zulkoski alleges was behind much of the wrongdoing, said in an interview that the whistleblower complaint contains inaccuracies and misconstrues actions that were undertaken before Zulkoski's short tenure.

"This is largely a misrepresentation of a lot of information," Sullivan said.

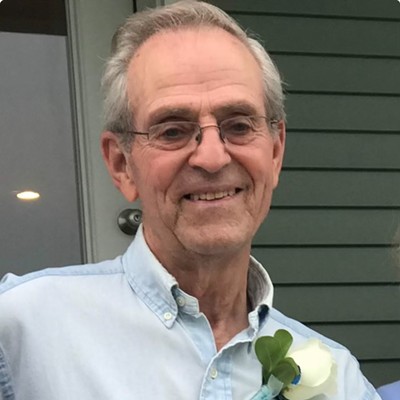

Zulkoski, 63, worked at iSun for just six weeks this spring, leading a three-person "triage team" that was recruited to turn around the failing company. The board of directors abruptly fired the team in late April. Zulkoski claims he was ousted after telling the directors about the financial allegations in his complaint and because he refused to sign the company's annual report to shareholders that failed to disclose the issues.

Zulkoski and two consultants who rounded out the triage team, Melissa Obegi and Andy Childs, are suing iSun for breach of contract.

In his separate whistleblower letter, Zulkoski claims he informed the independent members of iSun's board of directors of the wrongdoing he discovered and advised them to commission a forensic audit to look for evidence of potential lawbreaking.

Meer acknowledged that some of the alleged conduct was "terrible" in an email to Zulkoski, but otherwise the response from the board was "utter and complete inaction," Zulkoski's attorney wrote in the letter.

"At no point was there any intent or concern to actually remedy the issues," Zulkoski's complaint states. "Worse yet," the complaint continues, "there existed a real intent to quickly sell the Company to a buyer before any of these issues became public."

iSun is by far the largest solar installer in Vermont and one of a handful of publicly traded companies in the state. Born of a family-owned electrical contracting company, Peck Electric, the firm pivoted to solar and went public in 2019 as part of CEO Jeff Peck's vision to grow into a regional powerhouse in every sector of the burgeoning industry. The move brought millions in new investment capital to the Williston-based company.

After changing its name to iSun, the company bought Vermont residential solar installer SunCommon in 2021 for $40 million. The combined company employed as many as 350 people in recent years, though a round of sudden layoffs on the eve of bankruptcy has reduced the count to below 200.

In its quest to grow, iSun has never turned a profit, with operating losses as high as $53.8 million in 2022. The company was hemorrhaging $250,000 per week and "on the precipice of shutting down" when it filed for bankruptcy protection, Peck told a federal court in Delaware. The Chapter 11 filing was to keep iSun operating while it reorganized. Peck blamed the company's troubles on high interest rates, which drove up the cost of financing solar projects, hurt sales and made it more expensive for iSun to borrow cash. The company's stock sank so low it was delisted from the Nasdaq exchange; it currently trades at 2 cents.

iSun has identified a potential buyer in Texas-based energy investment firm Siltstone Capital, which appears poised to acquire the company's assets — reported as $66.7 million in 2023 — through a court-overseen auction, for as little as $10 million. A judge recently approved $4 million in emergency financing from Siltstone that will keep iSun afloat until the auction can take place.

iSun's board hired Zulkoski in March as the company's stock was plummeting. Zulkoski replaced Peck, whose father founded Peck Electric in the 1970s. When Zulkoski came aboard, Sullivan, the CFO, had tendered his resignation but not yet stepped aside. Zulkoski, a part-time Vermont resident, brought more than 30 years of experience in global finance and had invested more than $5 billion in fiduciary capital over his career, the board told investors. At the time, he was also a managing partner at Conduit Capital Holdings, which makes social and environmental impact investments, and a founding partner at Middlebury-based RuralWorks, which invests in rural businesses.

Six weeks later, iSun announced that Zulkoski was out and Peck would return as CEO alongside a new interim chief financial officer, Rob Vanderbeek. The public notice, in which Peck credited Zulkoski with charting a "remarkable journey" for the company, did not betray any of the behind-the-scenes acrimony.

Upon joining the company, Zulkoski told the SEC, he requested a list of employees and salaries from iSun's human resources department. The documents included a copy of iSun's 2020 loan application to the Paycheck Protection Program, the federal government's massive pandemic relief effort that gave companies forgivable loans to keep their employees on the payroll during lockdowns. iSun, under the name Peck Electric, received nearly $1.5 million during the initial round of funding to save 100 jobs.

According to Zulkoski's complaint, the 2020 PPP loan application included the spouses of executives on a list of iSun employees as a way to increase the amount of aid the company could receive. The complaint doesn't describe precisely how Zulkoski believes the "fraudulent" scheme was designed, but it states that the company later paid spouses of three senior executives as much as $50,000. In an email purportedly penned by Sullivan and quoted in the complaint, the CFO wrote that "bonus payments" would be paid to "our spouses in order to qualify for the forgiveness provisions."

The email and other documents are identified as exhibits to the SEC complaint, but the copy of the submission obtained by Seven Days did not include any attachments, and Seven Days has not reviewed them.

iSun has since reported that all of its PPP loans were forgiven by the U.S. Small Business Administration. In the years since the pandemic, federal prosecutors have brought criminal charges against recipients who defrauded the program, though Zulkoski wrote that he was unaware of any investigation targeting iSun.

Sullivan denied defrauding the PPP program and said executives' spouses, including his own, were not included on the loan applications and were not paid using PPP proceeds. The $50,000 payments cited by Zulkoski, Sullivan said, "were bonuses paid directly to the executives."

He would not say whether executives' spouses were ever paid during his time as chief financial officer.

Zulkoski also reported that iSun executives received company cars in their names without proper approval. Sullivan acknowledged that he took the title to his company car as part of his departure but said Peck personally authorized the transfer. He said he wasn't aware of employees misappropriating vehicles.

The letter also accuses Sullivan and Peck of misrepresenting iSun's revenue to lenders who provided financing in the months before its collapse. Last December, iSun secured an $8 million loan from a company called Decathlon Capital. The loan was not cheap: iSun would have to pay it back, plus at least $5.2 million in interest, by 2027.

The loan included a covenant that restricted iSun from borrowing additional funds without Decathlon's approval. Yet in the weeks that followed, iSun executives secured several more loans from what Zulkoski describes as "predatory lenders" without notifying its full board — or Decathlon. Public filings show iSun entered into $1.2 million "cash advance" agreements with Pawn Funding and Cedar Advance in early 2024.

Decathlon later accused iSun of defaulting on its $8 million loan, iSun disclosed in its bankruptcy filing, in part because iSun incurred new debt that wasn't permitted under the loan agreement.

iSun needed the cash to pay its bills. But Zulkoski alleges the loans were also used to pay bonuses to executives "during a time when the Company was (and still is) in great financial turmoil."

Peck and Sullivan were awarded bonuses last year of $267,500 and $152,500 respectively, Seven Days previously reported.

Sullivan said he was not responsible for the "cash advance" agreements because he had already told iSun of his intent to resign. Peck's name appears on the contracts. Company leaders, including Zulkoski, asked Sullivan to remain with iSun, though he ultimately declined.

Sullivan's decision to leave did not stem from "any disagreement with the Company, its management or its Board of Directors on any matter," the company's February announcement stated.

"I felt that it was just time to move forward and pursue some other opportunities," Sullivan said. He said he is currently working full-time but did not say where.

Shortly after iSun's June 3 bankruptcy filing, Zulkoski posted a comment on LinkedIn.

"I've seen bankruptcy used far too often to shelter poor decision making, oversight and governance by parties not putting their responsibility to shareholders and employees first," Zulkoski wrote.

He linked to a June 4 column in the New York Times about corporate abuses of U.S. bankruptcy law and tagged the three independent members of iSun's five-person board of directors: Stewart Martin, Andy Matthy and Meer.

iSun's bankruptcy petition shows its largest unsecured debt, $1.7 million, is owed to Colchester-based Green Mountain Electric Supply. The supplier already has filed suit against iSun in state court, claiming iSun owes it nearly $200,000 for equipment used on one recent project on the University of Vermont campus.

iSun also owes more than $400,000 to a Vermont chapter of the International Brotherhood of Electrical Workers, Local 300. The bankruptcy petition lists the debt as "union dues," but business manager Jeffrey Wimette said most of the money owed is for health and pension benefits. The labor union represented about 75 iSun employees, 36 of whom were laid off with no notice in May. So far, only about a third of the affected workers have found another job, Wimette said.

iSun started falling behind on contributions to employee health, welfare and pension funds last December, he said. An agreement is in place to repay the debt over time, which Wimette said he is optimistic the company will fulfill.

He hopes the company, a large employer, will be salvaged through the bankruptcy process. But Wimette said he's frustrated with iSun's leadership.

"A lot of people left because of mismanagement," he said.

Nor is Wimette pleased that union members lost their jobs while the executives received bonuses.

"They're not losing anything," he said. "Maybe their pride, but financially, they're fine."

Comments

Comments are closed.

From 2014-2020, Seven Days allowed readers to comment on all stories posted on our website. While we've appreciated the suggestions and insights, right now Seven Days is prioritizing our core mission — producing high-quality, responsible local journalism — over moderating online debates between readers.

To criticize, correct or praise our reporting, please send us a letter to the editor or send us a tip. We’ll check it out and report the results.

Online comments may return when we have better tech tools for managing them. Thanks for reading.