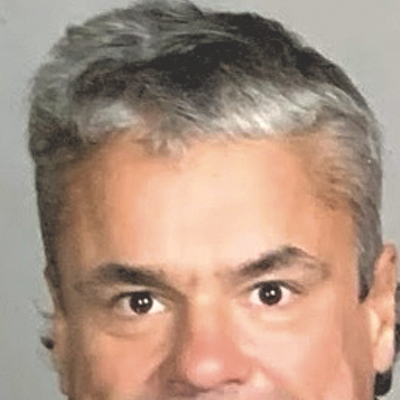

- Matthew Thorsen

- Beth Pearce

Vermont State Treasurer Beth Pearce wasn’t asking for votes or donations on a recent Saturday morning at the University Mall in South Burlington; she was looking to return money to the people who put her in office.

At an info booth near JCPenny, Pearce invited passing shoppers to consult a bank of computers to determine if the state of Vermont might be holding any unclaimed financial property that belonged to them.

A young man in a visored cap typed his name into a search function, and up came a hit. The man’s former employer had turned his final paycheck over to the state’s Unclaimed Property Office.

“Sweet!” the man exclaimed, shooting his arms upward, touchdown-style. “I just made $70!”

A few minutes later, a woman who searched the database was less impressed to learn she was owed just $8 and didn’t bother filing a claim.

But another shopper that same day was pleasantly surprised to discover he had $500 in “lost” stocks coming to him.

The state treasurer’s office is currently in possession of more than $59 million in unclaimed financial property owed to roughly 260,000 individuals and companies in Vermont. While only a fraction of that money ever gets back to its owners, Pearce is stepping up efforts — her missing-money road show, for one — to reunite people with their lost loot.

By all accounts, it’s working. In fiscal year 2012, the Treasurer’s Office returned more than $4.2 million to 14,537 claimants — the largest number of claims paid out since the program’s inception in 1954. Fiscal year 2013 is tracking to be even better: Pearce estimates that by June 30, her office will have returned another $5 million worth of unclaimed property from dormant bank accounts, stocks, tax refunds, overpaid hospital bills, utility deposits, unclaimed wages and insurance proceeds.

Pearce has had a hand in some big wins since she was appointed in 2010: Her office recently announced it had reached an agreement with three insurers to return $2.2 million in life-insurance benefits to around 2500 individuals.

“We’ve been working with other unclaimed property administrators across the country … engaging in audits of insurance companies … and we found a number of cases where the insured had passed away and the beneficiary had not received those benefits,” explains Pearce. In some cases, insurers couldn’t locate beneficiaries on very old policies. In others, the insurer might not have searched vigorously enough.

Working with industry groups such as the National Conference of Insurance Legislators, Pearce has focused on consumer legislation that would facilitate the process. She was recently elected president of the National Association of Unclaimed Property Administrators.

Closer to home, Pearce was a driving force behind a new state law that requires insurance companies to make “a good-faith effort” to find missing beneficiaries using a Social Security Administration database called “the Death Master File,” a searchable government roster of the deceased.

Currently, insurers can check that official list to determine if a policyholder has died and a benefit is due to someone who might not have known to claim it. But they aren’t required to make that search.

As it stands, a beneficiary’s claim is what triggers a life-insurance company to pay survivor benefits. Without a claim, the insurer has no affirmative responsibility to act.

Vermont’s new law, which takes effect July 1, holds insurers more accountable for finding claimants. “Insurance companies that sell both life and annuities had been using the Death Master File to search for deceased policyholders so they could stop making payments on the annuities side, but they hadn’t been using the list to identify beneficiaries to pay benefits on the life-insurance side of the business,” explains Vermont Department of Financial Regulation Commissioner Susan Donegan, whose office has jurisdiction over unfair insurance trade practices.

The new law empowers DFR to go after insurance companies that engage in this practice, known as “asymmetrical use of the Death Master File.” The new law will require life and annuity companies to periodically search the Death Master File for deceased holders of life insurance policies, so that beneficiaries are found and paid sooner. Perhaps most importantly, if a beneficiary cannot be identified, it requires companies to send unclaimed insurance proceeds to the state’s unclaimed property fund, at which point the treasurer will attempt to locate the beneficiary.

“If the Treasurer’s Office finds any evidence of non-compliance, it gets referred to us,” Donegan says. The new law should also bolster the state’s position in investigations already under way.

In the annals of unclaimed property in Vermont, there have been some real hidden treasures. Nine years ago, a Vermont bank turned over the contents of a safe-deposit box containing rare photos, autographs and handwritten notes from luminaries such as Salvador Dalí, Paul Klee, Grandma Moses, Paul Cézanne, Pablo Picasso, Ira Gershwin and Johannes Brahms. The lot belonged to the late F.C. Schang, who became president of Columbia Artists Management Inc. He was an agent for the Trapp Family Singers of Stowe.

Schang’s collection was thought to be worth roughly $100,000. With the help of a town clerk, then-state treasurer Jeb Spaulding eventually found the beneficiary: a former Vermont firefighter.

How could such a valuable collection go unclaimed? As Pearce explains, “Banks often merge with other banks over the years, so that’s one way things can get lost.”

How hard the Treasurer’s Office works to reunite people and their things is a topic of great speculation. The Vermont list is sprinkled with well-known entities, including the University of Vermont, Cabot Creamery, Ben & Jerry’s, National Life of Montpelier — even the U.S. Department of Homeland Security.

Does the presence of such high-profile claimants on the list suggest a less-than-energetic effort on the part of the state to contact them? What about the low-profile ones? How many of those might be easily located by, say, a savvy 11-year-old with an internet-connected device?

Pearce’s explanation: Some large companies with hundreds of separate small claims choose to file for them all just once a year.

As for lesser-known claimants, she says her office sends out roughly 11,000 official letters a year notifying people they have financial assets they apparently don’t know about; staff use lists of state employees, teachers and retirees, as well as other government databases, to make money matches. Media campaigns and public appearances are also part of the outreach effort.

The average claim on Vermont’s list is close to $300 but many unclaimed accounts are worth less than $10. Despite what Pearce describes as a new “express filing system which moves things a little faster for claims up to $200,” people who are owed small amounts often don’t bother.

Such explanations don’t satisfy everyone. Here and across the country, critics have complained about the enormous sums states hold in unclaimed property accounts — estimated at $41.7 billion. States put that cash-in-waiting to use; it doesn’t just sit there in a drawer. Vermont uses a portion of unclaimed funds for college scholarships.

At least in theory, if everyone suddenly filed claims simultaneously, it could have serious fiscal consequences. The value of Vermont’s unclaimed property — $59 million — is 4.5 percent of the state’s $1.3 billion general fund.

Wallace Nolen of Barre has a special interest in unclaimed property issues. The self-styled activist, who for some years has demonstrated an obsession with challenging the practices of government, holds that an aggressive return policy fundamentally goes against a state’s financial interests. Nolen most recently reported that he has organized a group of 500 volunteers to locate individuals whose names are on the unclaimed property list to help them claim their money — essentially, it would appear, assisting the treasurer in her statutory mission.

It’s not just a Vermont thing. In 2007, a federal judge in California stopped the state from seizing unclaimed financial assets, ruling it had not made enough of an effort to return unclaimed property to its rightful owners. In his opinion, U.S. District Judge William B. Shubb wrote, “If the purpose of the law is ... to reunite owners with lost or forgotten property, its ultimate goal should be to generate little or no revenue at all for the state.”

Pearce recently returned from Washington, D.C., where she testified before the Uniform Law Commission, which is considering updates to the federal Uniform Unclaimed Property Act. She is pushing for changes that would, in effect, lessen revenues for states by getting money to claimants before it reverted to unclaimed property.

Pearce seems to enjoy the challenge. Indeed, what politician — especially one who aspires to higher office — wouldn’t love the chance to reunite people with money they might not know they were owed?

Between greeting shoppers at the U-Mall, Pearce served notice on the higher-office point. “This is my passion … my life’s work,” she says of her job. “This is the only elective office I’m ever going to be looking at.”

Disclosure: Ricka McNaughton worked as communications officer for the Vermont Department of Banking, Insurance, Securities & Health Care Administration, now called the Department of Financial Regulation, from 1997 to 2009.

The state of Vermont might owe you money. Check the list of people with unclaimed property to see if your name’s there: missingmoney.vermont.gov. Or call 802-828-2407 or toll-free in Vermont, 1-800-642-3191.

Comments

Comments are closed.

From 2014-2020, Seven Days allowed readers to comment on all stories posted on our website. While we've appreciated the suggestions and insights, right now Seven Days is prioritizing our core mission — producing high-quality, responsible local journalism — over moderating online debates between readers.

To criticize, correct or praise our reporting, please send us a letter to the editor or send us a tip. We’ll check it out and report the results.

Online comments may return when we have better tech tools for managing them. Thanks for reading.